4 2: Discuss the Adjustment Process and Illustrate Common Types of Adjusting Entries Business LibreTexts

Similarly, for unearned revenue,when the company receives an advance payment from the customer forservices yet provided, the cash received will trigger a journalentry. When the company provides the printing services for thecustomer, the customer will not send the company a reminder thatrevenue has now been earned. Situations such as these are whybusinesses need to make adjusting entries. When you make an adjusting entry, you’re making sure the activities of your business are recorded accurately in time.

Accrued Revenues

Adjustment entries ensure that all expenses and revenues are recorded in the correct period, even if they were not initially recorded. Amortization is the allocation of the cost of an intangible asset over its useful life. To record amortization, an accountant would debit an expense account and credit an accumulated amortization account.

Bookkeeping and accounting software

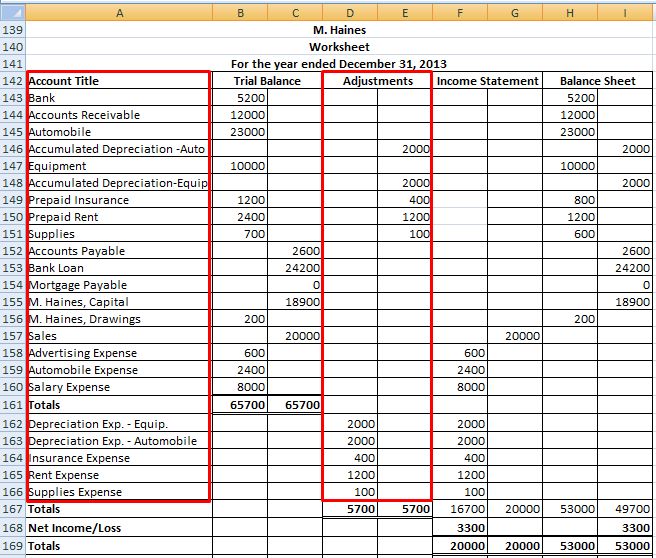

Using the tableprovided, for each entry write down the income statement accountand balance sheet account used in the adjusting entry in theappropriate column. Accruals are types of adjusting entries thataccumulate during a period, where amounts were previouslyunrecorded. The two specific types of adjustments are accruedrevenues and accrued expenses. Recall that unearned revenue represents a customer’s advancedpayment for a product or service that has yet to be provided by thecompany. Since the company has not yet provided the product orservice, it cannot recognize the customer’s payment as revenue. Atthe end of a period, the company will review the account to see ifany of the unearned revenue has been earned.

Accrued Expenses

At the end of hisfirst month, he reviews his records and realizes there are a fewinaccuracies on this unadjusted trial balance. Adjustment entries can impact a business’s cash flow by affecting the timing of cash inflows and outflows. For example, if an adjustment entry is made to increase accounts receivable, this will increase the amount of cash that the business expects to receive in the future. On the other hand, if an adjustment entry is made to increase accounts payable, this will decrease the amount of cash that the business expects to pay in the future.

Unlike accruals, there is no reversing entry for depreciation and amortization expense. Our partners cannot pay us to guarantee favorable reviews of their products or services. If the revenues earned are a main activity of the business, they are considered to be operating revenues. If the revenues come from a secondary activity, they are considered to be nonoperating revenues.

What are the main purposes of accounting?

Now that we know the different types of adjusting entries, let’s check out how they are recorded into the accounting books. In the journal entry, Salaries Expense has a debit of $1,500.This is posted to the Salaries Expense T-account on the debit side(left side). You will notice there is already a debit balance inthis account from the January 20 employee salary expense. The$1,500 debit is added to the $3,600 debit to get a final balance of$5,100 (debit). Salaries Payable has a credit balance of $1,500.This is posted to the Salaries Payable T-account on the credit side(right side). Thisis posted to the Supplies Expense T-account on the debit side (leftside).

- The entries are made in accordance with the matching principle to match expenses to the related revenue in the same accounting period.

- An income which has been earned but it has not been received yet during the accounting period.

- The Vehicles account is a fixed asset account on your balance sheet.

- Accrued expenses are expenses incurred in aperiod but have yet to be recorded, and no money has been paid.Some examples include interest, tax, and salary expenses.

Because you know your inventory amount has decreased by $3,750, you will adjust your actual inventory number instead of posting to the reserve account. We believe everyone should be able to make financial one company purchases another in an acquisition decisions with confidence. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

The accounting period is the period of time for which financial statements are prepared, usually one year. The accounting cycle is the process of recording, classifying, and summarizing financial transactions for a given accounting period. Insurance Expense, Wages Expense, Advertising Expense, Interest Expense are expenses matched with the period of time in the heading of the income statement. Under the accrual basis of accounting, the matching is NOT based on the date that the expenses are paid. Thisis posted to the Unearned Revenue T-account on the debit side (leftside).

To get started, though, check out our guide to small business depreciation. Once you’ve wrapped your head around accrued revenue, accrued expense adjustments are fairly straightforward. They account for expenses you generated in one period, but paid for later. Adjusting entries are typically made after the trial balance has been prepared and reviewed by your accountant or bookkeeper. Sometimes, your bookkeeper can enter a recurring transaction, and these entries will be posted automatically each month before the close of the period. The Inventory Loss account could either be a sub-account of cost of goods sold, or you could list it as an operating expense.

Instead, it is used up over time, and this use is recorded as a depreciation expense. Whereas you’d record a depreciation entry for a tangible asset, amortization is used to stretch the expense of intangible assets over a period of time. At year-end, half of December’s wages have not yet been paid; they will be paid on the 1st of January. If you keep your books on a true accrual basis, you would need to make an adjusting entry for these wages dated Dec. 31 and then reverse it on Jan. 1. If you have adjusting entries that need to be made to your financial statements before closing your books for the year, does that mean your books aren’t as accurate as you thought?

Then, in February, when the client pays, an adjusting entry needs to be made to record the receivable as cash. Uncollected revenue is revenue that is earned during a period but not collected during that period. Such revenues are recorded by making an adjusting entry at the end of the accounting period. As an example, assume a construction company begins construction in one period but does not invoice the customer until the work is complete in six months. The construction company will need to do an adjusting journal entry at the end of each of the months to recognize revenue for 1/6 of the amount that will be invoiced at the six-month point.